Investing in U.S. Coins: Building a Valuable Coin Portfolio

Why Invest in U.S. Coins?

Investing in U.S. coins is an exciting and potentially lucrative way to diversify your investment portfolio. Unlike traditional investments like stocks or bonds, rare coins can offer the dual benefit of historical significance and potential appreciation in value. Coins made from precious metals like

gold and

silver or those with unique designs, such as

pattern coins, often hold or even increase in value over time, making them an attractive option for investors looking to expand their portfolios.

Building a coin portfolio offers more than just a financial opportunity—it’s also a way to connect with U.S. history, as each coin carries with it a story about the nation’s past. This blog will guide you through the essentials of investment coins, how to start a coin portfolio, and the advantages of integrating rare U.S. coins into your investment strategy.

What Are Investment Coins?

Investment coins are coins purchased primarily for their potential to increase in value over time. Unlike coins collected for aesthetic or sentimental reasons, investment coins are selected for their ability to retain or grow in value. The value of these coins is influenced by factors like their metal content, historical significance, rarity, and demand in the market.

There are several types of coins that make excellent investments:

- Gold Coins: Gold is one of the most popular precious metals for investment.

American Gold Eagles,

Liberty Head gold coins, and other U.S. gold bullion coins are excellent examples of coins that can appreciate in value over time.

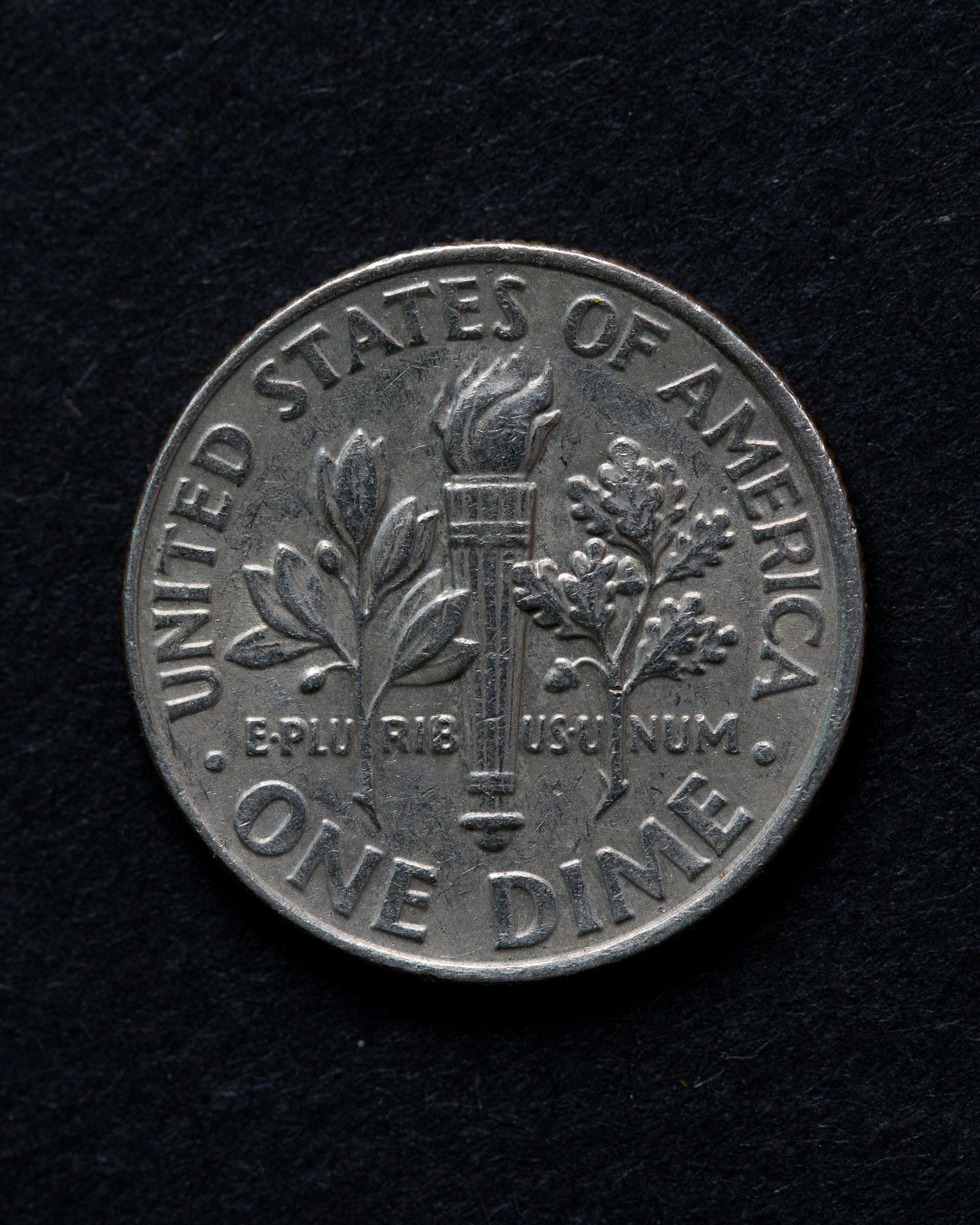

- Silver Coins: Coins like the

American Silver Eagle or

Morgan Silver Dollar have both precious metal content and collector value, making them highly attractive to investors.

- Rare Coins: Certain rare coins, such as

pattern coins or

Civil War coins, hold value because of their scarcity and historical importance. These coins often have the potential to see significant appreciation in price.

Investment coins are an excellent hedge against inflation and economic uncertainty, making them a popular choice for diversifying a portfolio. Many collectors and investors also choose coins due to the security they offer in volatile markets.

Why Invest in Gold Coins?

Gold coins have long been viewed as a safe haven investment. The price of gold tends to rise during times of economic instability, making gold coins a solid choice for anyone looking to safeguard wealth.

Some of the most popular U.S.

gold coins include:

- American Gold Eagle: Minted by the U.S. Mint, these coins are widely recognized and sought after for both their gold content and collectible value.

- Indian Head Gold Coins: Minted from 1907 to 1933, these coins are highly valued for their beautiful design and their gold content, making them a staple in many investors’ portfolios.

- Saint-Gaudens Double Eagle: One of the most iconic gold coins in American history, this coin is often sought after by investors due to its design and gold content.

Gold coins are typically valued based on their weight in gold (measured in troy ounces) and their condition. Many investors choose gold coins not just for their intrinsic value but also for the potential to see long-term appreciation. Investing in gold coins offers a level of diversification and protection that traditional investments cannot always provide.

The Appeal of Silver Coins as Investments

While gold is often the primary focus of coin investors, silver coins also make excellent additions to any coin portfolio. Silver has long been a reliable store of value, and silver coins are particularly attractive for those looking to invest in precious metals without the high price tag associated with gold.

- American Silver Eagles: These coins are highly collectible and made from one ounce of .999 fine silver. They are among the most recognized silver coins in the world and have a high potential for long-term growth.

- Morgan Silver Dollars: Minted from 1878 to 1904, these coins are loved by collectors and investors alike. Their historical significance and silver content make them an appealing choice for any coin portfolio.

- Walking Liberty Half Dollars: Produced from 1916 to 1947, these coins are valued for both their design and silver content, offering another attractive option for silver investors.

Silver coins offer a balance between the affordability of precious metals and the long-term potential for growth. Due to their metal content and widespread recognition, silver coins can become valuable not just as a commodity but as an investment piece over time.

Building a Coin Portfolio: Why Diversify?

A coin portfolio is similar to a traditional investment portfolio in that it benefits from diversification. Diversifying your portfolio of rare coins allows you to manage risk by investing in different types of coins with varying levels of risk and potential for appreciation.

Here are a few reasons why diversification is important when building a coin portfolio:

- Different Coins Appreciate Differently: Certain coins, like gold coins, may perform better in times of economic uncertainty, while others, like silver coins or rare Civil War coins, may see greater appreciation as demand grows among collectors.

- Tangible Assets: Coins are physical, tangible assets that can be stored securely. Unlike stocks or bonds, you hold the actual item, and its value is backed by the metal content, rarity, and historical context.

- Market Volatility:

The market for coins can fluctuate based on factors such as precious metal prices, collector demand, and overall economic conditions. By diversifying your coin collection, you ensure that your investments have the potential to appreciate regardless of market trends.

A well-rounded coin portfolio might include a mixture of gold coins, silver coins, rare coins like pattern coins, and even more affordable items like American Silver Eagles. By holding a variety of types of coins, you increase your chances of benefiting from both the precious metal value and the collector market demand.

How to Start Your Coin Investment Portfolio

Building a coin portfolio requires some planning and strategy.

Here’s how to get started:

- Define Your Investment Goals: Are you looking for long-term growth, a hedge against inflation, or just a way to diversify your portfolio? Knowing your goals will help you select the right coins.

- Research the Market: Learn about different types of investment coins and understand how they perform in the market. Follow market trends and study the demand for specific coins like gold or silver coins.

- Start with Precious Metals: If you’re new to coin investing, it’s often a good idea to start with gold coins and silver coins because of their relatively stable value and their universal recognition in the market.

- Consider Rare Coins: Once you’ve established a foundation with precious metals, consider adding rare U.S. coins, such as Civil War coins or pattern coins, which have both historical significance and investment potential.

- Buy from Reputable Dealers: Always purchase your coins from trusted dealers who can authenticate and grade the coins. This ensures you’re investing in genuine, high-quality pieces.

Starting small with a few carefully chosen coins and gradually expanding your collection is a great way to begin building a solid coin investment portfolio.

The Role of Coin Grading in Investment Coins

Coin grading is an essential part of coin investing. Grading determines the coin's condition and can greatly influence its value. Coins are graded on a scale from 1 (poor condition) to 70 (perfect condition), and the higher the grade, the higher the coin’s value.

Coins with high grades (such as

MS70 for mint state) are much more desirable to investors, as they are often rarer and more collectible. When buying

investment coins, it’s crucial to know the coin’s grade to understand its value accurately.

Many collectors and investors also prefer

graded coins because they offer a level of protection against counterfeit items and ensure that the coin has been evaluated and certified by a professional service.

Storing Your Coin Portfolio Safely

Proper storage is critical to maintaining the value of your coin collection.

Here are some tips for protecting your investment coins:

- Use Protective Slabs: For

graded coins, invest in

slabs—hard plastic holders that protect coins from physical damage and ensure their condition remains intact.

- Climate Control: Coins should be stored in a cool, dry environment. Extreme temperatures or humidity can cause damage to coins, especially those made of silver or copper.

- Secure Storage: For high-value coins, consider using a

safe deposit box at a bank or a

secure home safe to ensure your coins are protected from theft or damage.

Proper storage not only protects the physical integrity of your coins but also helps preserve their long-term value.

The Potential Returns of a Coin Portfolio

The returns on an investment in

coins can vary based on several factors, including the coin’s metal content, rarity, condition, and demand. However, many collectors and investors have seen significant returns over time, especially when coins are carefully selected and maintained. The market for

gold coins and

silver coins is often influenced by global economic conditions, making them a valuable hedge against inflation.

Rare coins, such as pattern coins and Civil War coins, have the potential for even higher returns as they increase in scarcity and demand over the years. In general, a well-maintained coin portfolio can see substantial appreciation in value, particularly for high-quality, rare pieces.

Start Building Your Coin Investment Portfolio Today

Investing in U.S. coins offers a unique opportunity to diversify your portfolio with tangible assets that have both historical significance and financial potential. By focusing on

investment coins, such as

gold coins and

silver dollars, and carefully building a diversified

coin portfolio, you can position yourself for long-term growth. Understanding grading, selecting coins with strong investment potential, and storing them properly are all essential steps in creating a successful coin portfolio.

Start your coin investment journey today, and begin exploring the rich world of U.S. coinage as both a collector’s passion and a financial asset.